Antwort How much does DEGIRO charge in Germany? Weitere Antworten – How much does DEGIRO charge for stocks

Summary. In a nutshell, you pay a €1.00 transaction fee for ETFs in the DEGIRO core selection. For all other ETFs, you pay €3.00 per transaction. On top of the transaction fee, there's a connectivity fee of €2.50 per stock exchange per year.DEGIRO charges a fee to set up trading opportunities outside of your home market. This is to provide access to a large number of exchanges. This fee is levied upon those who are using these exchanges.Product costs are not paid to DEGIRO but to the provider of the products and are included in the price. To estimate the costs of the ETF provider, we use a total expense ratio (TER) of 0.28%. For Investment Funds, we use a 0.97% average expense ratio.

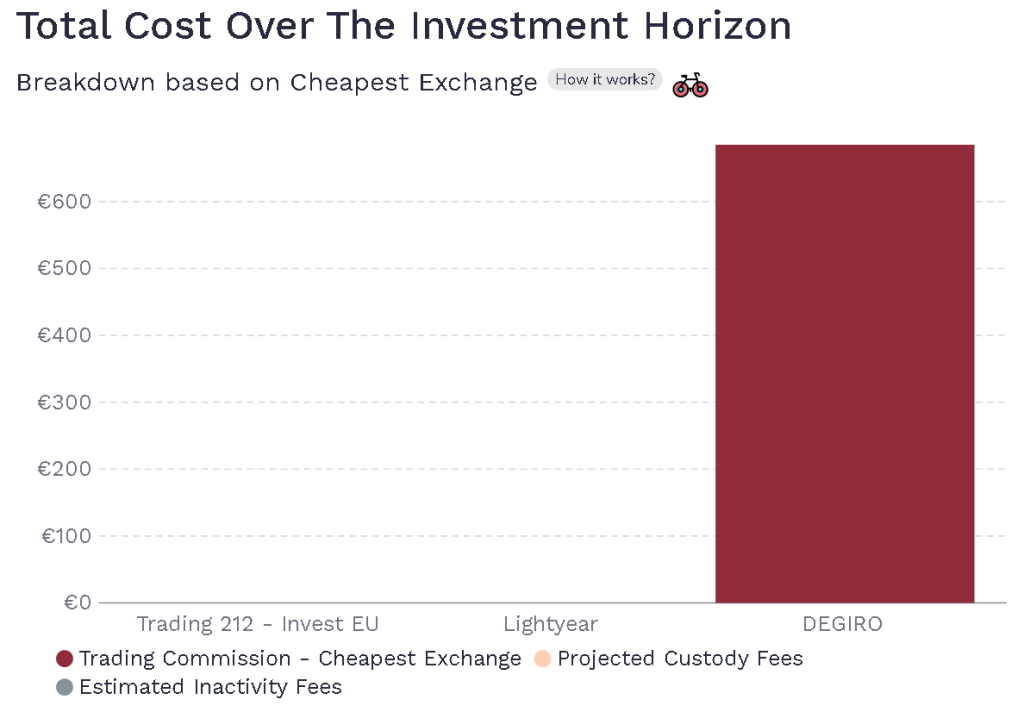

Are DEGIRO fees high : DEGIRO charges low fees for trading stocks and ETFs. There is no inactivity fee even if you leave your account idle for a long time. The basic withdrawal fee is $0, but some transactions may cost more. Read our full review of DEGIRO for info on safety, trading platforms and funding.

Does DEGIRO charge a monthly fee

For the connection fees you will pay a maximum of 0.25% of your total portfolio value (with a maximum charge of €2.50) per annum for each exchange with the exception of Irish Stock Exchange. The connectivity fee for US options is €5.00 per exchange per calendar month.

Is DEGIRO good for beginners : Is DEGIRO good for beginners Yes, our platform is for everyone! Whether you have just started your investment journey or are an experienced investor, we have the right tools for you.

The sole task of this entity is to administer and safeguard your investments. By law, it cannot perform any commercial activities. In the event that something would happen to DEGIRO, your investments will not be treated as recoverable assets to creditors and will remain in the safekeeping of the separate entity.

Keeping your investments and cash safeguarded is our top priority. DEGIRO uses a separate custodian entity to hold your assets. In the event something happens to DEGIRO, your investments will not be treated as recoverable assets to creditors.

Is DEGIRO a German broker

DEGIRO is the Dutch branch of flatexDEGIRO Bank AG. As a part of flatexDEGIRO Bank, we have our own banking license. That means your deposit is protected up to €100,000. We are supervised by the German Federal Financial Supervisory Authority (BaFin) and by the DNB and the AFM in the Netherlands.Every broker is available in Germany.

- eToro. Best online score: 4.8/5.

- XTB. Best online score: 4.8/5.

- DEGIRO. Best online score: 4.6/5.

- Lightyear. Best online score: 4.6/5.

- Trading 212. Best online score: 4.5/5.

- Trade Republic. Best online score: 4.5/5.

- Plus500. Best online score: 4.5/5.

- Oanda. Best online score: 4.5/5.

How Much are the Brokerage Costs The brokerage fees vary from 3% to 7% of the purchase price of the property, and up until recently, the seller could pass the total amount on to the buyer.

Germany's leading trading partners in 2022, by total volume of foreign trade. In 2022, Germany did the most trade with China, almost 299 billion euros worth. The USA and the Netherlands were also in the top three. The value of trade with the listed countries refers to both imports and exports.

Which stock broker has the lowest fees : Zerodha: Known for its low brokerage fees, Zerodha has become a popular choice among traders and investors. With their innovative technology and user-friendly platform, they offer excellent value for money. 2. Upstox: Offering zero brokerage on delivery trades, Upstox is another budget-friendly option for traders.

Which forex broker is best for Germany : Intro and winners

- Saxo Bank is the best forex broker in Germany in 2024 – Massive number of currency pairs.

- Fusion Markets – One of the lowest commissions on the market.

- Global Prime – Low forex fees.

- IC Markets – Low FX commission and tight spreads.

- Pepperstone – Low FX commission and tight spreads.

Who is Germany’s number one trading partner

The People's Republic of China is again Germany's main trading partner. According to preliminary results, goods worth 254.1 billion euros were traded between Germany and the People's Republic of China in 2023 (exports and imports).

automobiles

Germany is by far the world's largest exporter of automobiles: accounting for 15.4% of exports, automobiles and their parts were its main export product in 2022, with a value of around EUR 245 billion (Destatis). Machinery (13.3%) and chemical products (10.3%) ranked second and third, respectively.Free Equity Delivery Brokers

| Broker | Brokerage (Delivery) | Request Callback |

|---|---|---|

| Zerodha | Rs 0 (Free) | Open Account |

| Angel One | Rs 0 (Free) | Open Account |

| Fyers | Rs 0 (Free) | Open Account |

| Alice Blue | Rs 0 (Free) | Open Account |

Which broker does not charge fees : mStock by Mirae Asset is the best stockbroker with zero brokerage charges. At a one-time account opening fee of rs. 999, they offer lifetime zero brokerage trading on segments like Intraday, Delivery, F&O, etc. Whereas other brokers in the industry charge a brokerage of Rs.