Antwort How much tax do traders pay in Germany? Weitere Antworten – What is the tax for traders in Germany

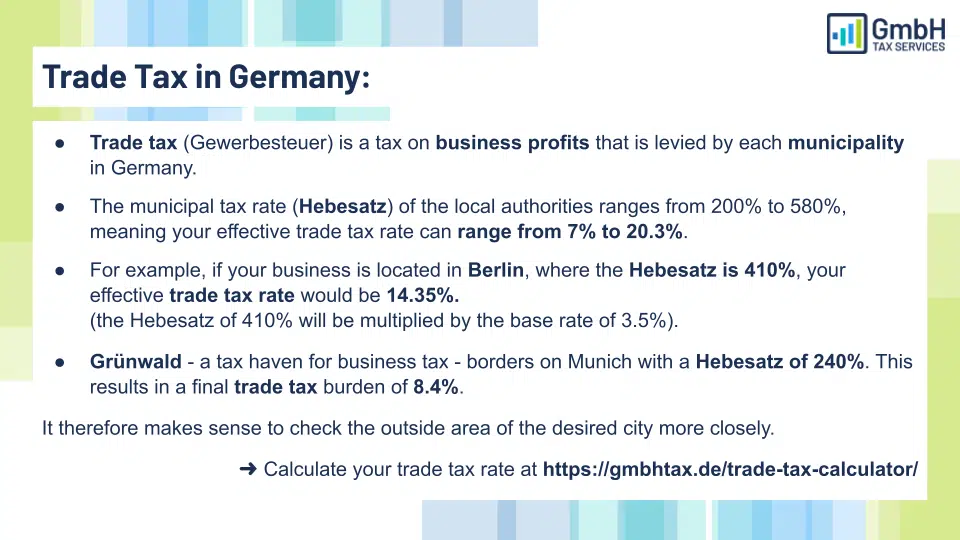

How much is the trade tax In Berlin, trade tax is 14.35% of your profit. As a sole proprietor, you get most of it back as tax credits. In the end you pay 1.05% more taxes in total.The minimum trade tax rate must be at least seven percent. There is no statutory ceiling of the trade tax rate, but the German average trade tax rate is slightly above 14 percent. As a rule, the trade tax rate tends to be higher in urban locations than in rural areas.Example 1

| Income Slab | Tax rates |

|---|---|

| 0 – Rs.2.5 lakh | 0 |

| Rs.2.5 lakh – Rs.5 lakh | 5% = Rs.12,500 |

| Rs.5 lakh – Rs.10 lakh | 20% = Rs.1 lakh |

| Rs.10 lakh and above | 30% = Rs.1.5 lakh |

What tax do you pay on trading : Capital Gains Tax

It doesn't matter whether you're self-employed, a part-time or full-time day trader. As long as your gains exceed the threshold, you'll be liable for capital gains tax.

Do forex traders pay tax in Germany

IF you are not a resident of Germany, you are not a german tax subject, so no taxation at all. IF you are a german resident, you are a german tax subject, so taxation: IF your broker is a german firm they will deduct 25 % plus 5% on these (total 26.25%) when the gain has been made (trade closed).

Do day traders pay taxes : How day trading impacts your taxes. A profitable trader must pay taxes on their earnings, further reducing any potential profit. Additionally, day trading doesn't qualify for favorable tax treatment compared with long-term buy-and-hold investing.

One must pay a flat tax rate on all the profits earned through private investments which is; 25% Flat Tax including the Solidarity Surcharge of 5.5% which is a total of 26.375% if you are a member of church then you need to also include the Kirchensteuer (Church Tax)to it which ranges from 8% – 9%.

With a $10,000 account, a good day might bring in a five percent gain, which is $500. However, day traders also need to consider fixed costs such as commissions charged by brokers. These commissions can eat into profits, and day traders need to earn enough to overcome these fees [2].

Do day traders have to pay taxes

How day trading impacts your taxes. A profitable trader must pay taxes on their earnings, further reducing any potential profit. Additionally, day trading doesn't qualify for favorable tax treatment compared with long-term buy-and-hold investing.It's important to note that while forex trading is legal and regulated in Germany, it also carries a certain level of risk. Therefore, traders should approach the market with care, use appropriate risk management strategies, and consider their risk tolerance when trading in the forex market.How Am I Taxed for Forex Trading If you trade 1256 contracts, your trades are taxed at 60% long-term capital gains and 40% short-term capital gains. If you're trading 988 contracts, you treat losses and gains as ordinary (taxed at your income tax bracket level).

$3,000

Trader tax status also allows day traders to make an election for something called mark to market. A day trader who does not have trader tax status can only write off up to $3,000 in trading losses when they file taxes, but those with mark to market election can claim greater losses, if applicable.

How can I reduce my taxable income in Germany : A tax declaration lets you deduct expenses from your income. This makes your taxable income smaller, so you pay less income tax. Relocation costs, business expenses, commuting, pension payments, insurance and healthcare are tax-deductible.

Is it possible to make $1000 a day trading : While it's theoretically possible to earn $1,000 daily through day trading or stock market investments, it's important to note that such earnings are not guaranteed, and they come with significant risks. Day trading and stock market investments can be highly volatile, and there are no guarantees of profits.

Can I day trade with a full time job

Even if you are trading full time, you still have other commitments such as family, friends, social life and other investments perhaps that need managing as well. Day trading requires a lot of time and dedication but there are ways to fit trading around a full time job, family and friends.

Short-term, extremely volatile financial instruments are available to German day traders. You must be concerned about stock market crashes as a long-term trade investor in Germany, but with day trading in Germany German traders are adept at making swift short-term trading decisions in choppy markets.Vietnam, Singapore, Switzerland, and Australia are some of the best countries for forex traders to reside in. However, there are also other ideal destinations such as New Zealand, Canada, and Hong Kong. It is also important to note that each country has its own regulations and guidelines for forex trading.

Do day traders have to pay income tax : Whether you're thinking about day trading or already doing it, you should know that this will likely impact your taxes. We'll give a broad overview of what you may expect and some key terms you may encounter. It shouldn't come as a surprise that you must pay taxes on your earnings, which cuts into any potential profit.

%20(1).jpg)