Antwort Is there no more tax class 3 and 5 in Germany? Weitere Antworten – Is Germany tax class 3 and 5 removed

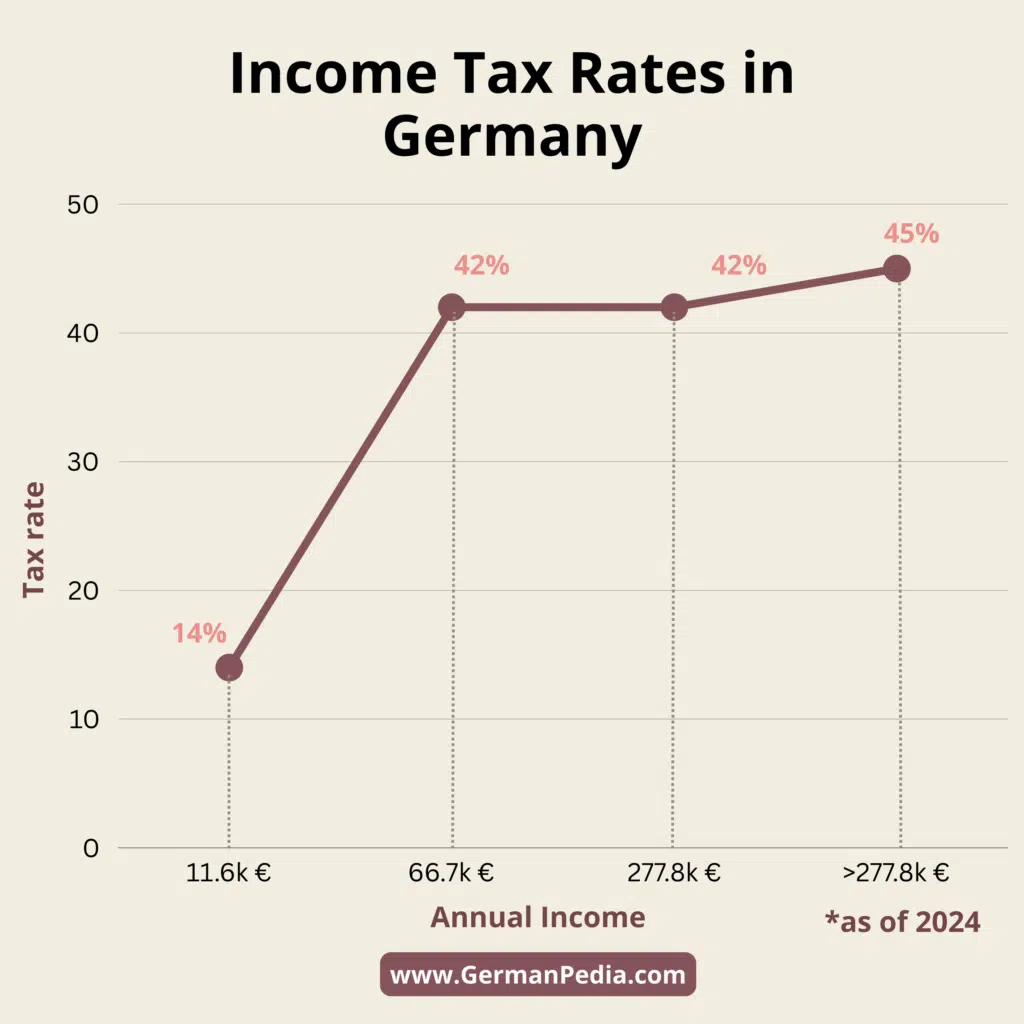

Moreover, the federal government plans to abolish the 3/5 tax class combination in its coalition agreement. Hence, the German government will transfer married couples to the 4/4 variation with a factor in the future.Tax Class 5: Married Couples in Combination With Tax Class 3. A married person is assigned tax class 5 a spouse if the other spouse (who has a higher income) changes to tax class 3 upon request. The lower-income spouse in tax class 5 is then taxed higher.The most important tax changes in 2024. Grundfreibetrag: The basic tax-free allowance or Grundfreibetrag increases from €10,908 to €11,604. For spouses who file a joint tax return, this amount doubles to €23,208. An additional increase of €180 is planned but not yet in effect.

How to change tax class 4 to 3 : Changing tax classes

Married persons and registered partners can apply for a change of tax class at a local tax office. There must be an intact marriage or civil partnership in order to be able to choose between several tax class combinations. Permanent separation terminates the requirements.

What is tax class 3 5 in Germany

The larger earner then applies for tax class III and benefits from a higher allowance and lower tax rate than class V. The tax rate is then the same for both partners, and the member of tax class III pays 60% while the other in tax class V pays 30%.

What is a Class 3 tax in Germany : Tax class III applies to married/partnered employees upon application if both spouses/life partners reside in Germany, do not live permanently separated, and the employee's spouse/life partner does not receive wages or receives wages and is placed in tax class V.

The third tax class is limited to married couples with both partners living in Germany. To belong to this tax class, one member of the marriage must be assigned to tax class V. Tax class III has the lowest taxation and double the allowance. The minimum monthly wage required to belong is again €450.

According to recent wage negotiations, German workers can expect an average wage increase of about 4.7% in 2024. This is almost double the average wage increase of 2.5% in 2023. Tip: What is the usual salary in my profession

How much money could taxpayers in Germany save in 2024

For example, a single person with an income of €3,000 per month will have a total of €172 more at their disposal in 2024 compared to 2023, despite rising contributions. A single person earning €5,000 per month will have €292 more left in their wallet over the year, according to the calculations.A good salary in Germany is usually above Germany's median salary of 44.074 euros gross a year and above the average gross wage of 51.009 euros gross a year. A salary between 64.000 and 70.000 euros gross a year is considered a good salary in Germany.A good salary in Germany is usually above Germany's median salary of 44.074 euros gross a year and above the average gross wage of 51.009 euros gross a year. A salary between 64.000 and 70.000 euros gross a year is considered a good salary in Germany.

How Good Is A Salary Of 60.000 Euros In Germany As you do your research, you may see in different forums that 60.000 euros gross a year in Germany is considered to be a good gross salary. It is well above the average salary of 47.700 euros per year and slightly above the national average.

What will Germany minimum wage be in 2025 : For comparison: the general statutory minimum wage nationwide is 12.41 euros per hour; from January 1, 2025, it will be 12.82 euros.

How much is minimum wage in Germany 2024 : 12.41 euros per hour

Note: If the statutory instruments listed above prescribe a gross minimum wage that is lower than the general statutory minimum wage of 12.41 euros per hour, the latter is to be applied as the lowest earnings limit from 1 January 2024.

How can I reduce my tax in Germany

Personal deductions

- Alimony payments. Individual taxpayers may take deductions up to EUR 13,805 for the alimony paid to a divorced partner.

- Charitable contributions.

- Childcare expenses.

- Education expenses.

- Social security contributions.

- Mortgage deduction.

To reach the top 1 percent of earners, you would need a monthly take-home salary of 7.190 euros. This is equivalent to an annual net income of almost 86.000 euros, after taxes, or an annual gross salary of around 150.000 euros.A good annual gross salary in Germany is between €64,000 to €81,000.

Is 140k euro a good salary in Germany : With a base salary of 140000 euros and a further 42000 euros of variable pay, it provides a very comfortable living for a family of four. 140k is a very respectable pay in Germany be it before or after taxes. Of course you might want to research Germany first before you come here.