Antwort What is the difference between SWOT and Porter’s 5 forces? Weitere Antworten – What is the difference between SWOT and Porter’s five forces

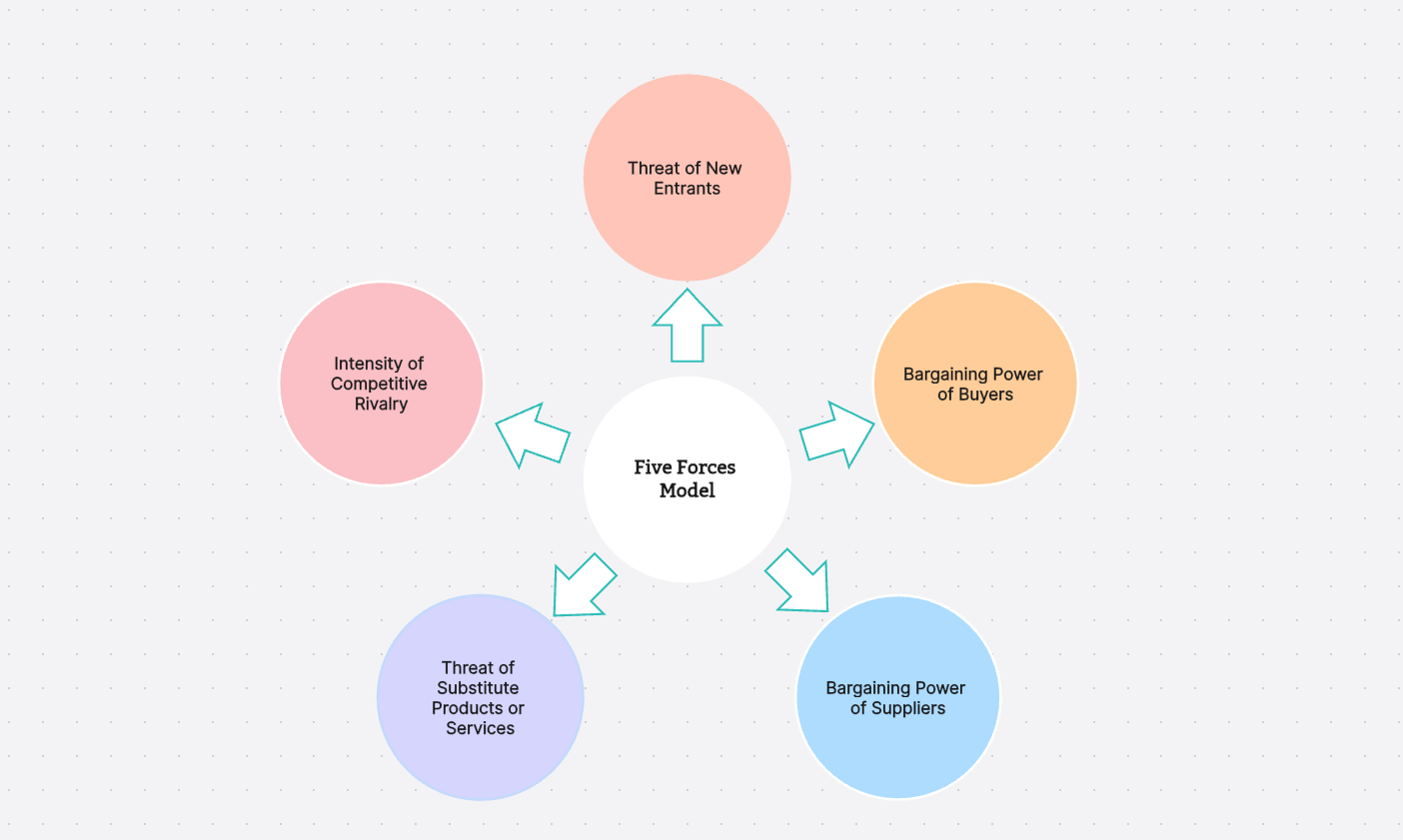

Porter's 5 Forces is a comparative analysis strategy that analyzes competitive market forces within an industry. SWOT analysis looks at the strengths, weaknesses, opportunities, and threats of an individual or organization to analyze its internal potential.Porter's Five Forces include: Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, and Threat of New Entry. The model encourages organizations to look beyond direct competitors when assessing strategy and, instead, consider broader environmental forces.They aid in identifying opportunities and threats from the external environment. Porter's Five Forces focuses on the competitive dynamics within a specific industry, while PESTEL analysis examines the broader macro-environment.

What is the difference between Porter’s five forces and resource based view : Porter's value chain is an external perspective that looks at how your business interacts with your customers, suppliers, and other stakeholders in the industry. The resource-based view is an internal perspective that looks at how your business leverages your own resources and capabilities to create value.

How can SWOT and a five forces model work together

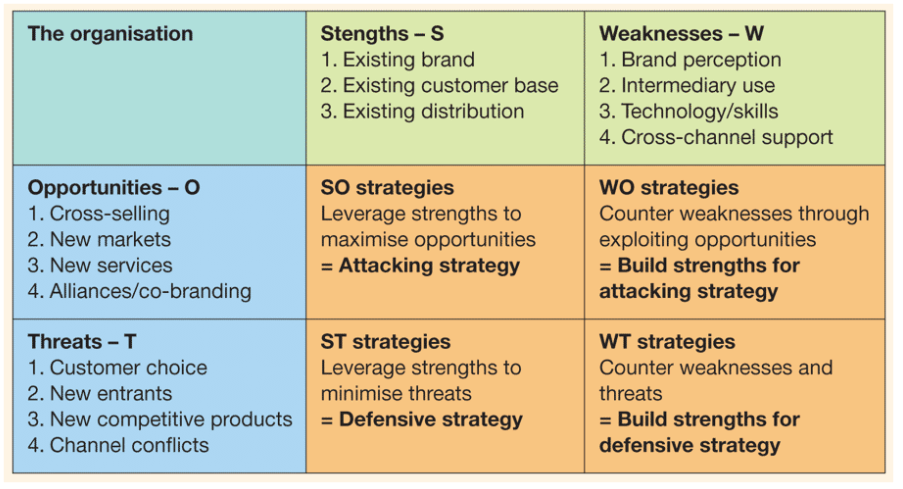

By comparing your SWOT matrix with your Porter's five forces analysis, you can identify how your strengths and weaknesses align with the opportunities and threats from the five forces.

What is the strongest force of Porter’s five forces : Competitive rivalry

Porter's Five Forces is a framework based on the competitive forces that influence an industry the most, and it helps us determine whether we can be successful in an industry. These forces are: Competitive rivalry, which is the strongest influence on whether entering an industry would be profitable.

Once you're ready, it's time to get started.

- Evaluate your competitors. The first step is to evaluate the strength of your current competition.

- Calculate your suppliers' bargaining power.

- Evaluate your buyer's bargaining power.

- Identify the threat of potential new entrants to the market.

- Evaluate the threat of substitution.

Porter wrote in 1980 that strategy targets either cost leadership, differentiation, or focus. These are known as Porter's three generic strategies and can be applied to any size or form of business. Porter claimed that a company must only choose one of the three or risk that the business would waste precious resources.

What is SWOT PESTLE and Porter analysis

Sometimes called PESTLE analysis when legal and environmental impacts are also included. An example of Porters Five Forces is the Supplier power, Buyer power, Competitive rivalry, Threat of substitution, and Threat of new entry. A SWOT analysis considers a company's strengths, weaknesses, opportunities, and threats.The main differences between a SWOT or PESTLE analysis are that a SWOT analysis focuses on actions you can take INTERNAL to your business environment, a PESTLE analysis identifies EXTERNAL factors that are mainly outside of your control.SWOT involves analyzing a company's strengths, weaknesses, opportunities and threats, and RBV means adopting a resource-based view for goal setting by identifying a firm's valuable resources and using them to develop a competitive advantage.

Some other frameworks similar to Porter's Five Forces include PESTEL Analysis, SWOT Analysis, and Value Chain Analysis. These frameworks also provide a comprehensive view of the external and internal factors affecting a business.

What is better than SWOT analysis : A SOAR analysis maintains the Strengths and Opportunities sections of a SWOT analysis but introduced Aspirations and Results in the place of Weaknesses and Threats. Aspirations focus on what the organization wants to do, who they want to serve, and where they wish to operate.

Are Porter’s 5 forces internal or external : As the name suggests, there are five factors that make up Porter's 5 Forces. They are all external, so they have little to do with the internal structure of a corporation: Industry competition: A higher degree of competition means the power of competing companies decreases.

What is a real life example of Porters Five Forces

The Threat of Buyers Opting for Substitute Products

Within the framework of Porter's Five Forces Model, substitute products are not direct competitors but possible substitutes. In the case of Apple, an example of a substitute product might be a landline telephone as a substitute for an iPhone.

Apple

Porter's five forces for Apple shows that the two strong forces are industry competition and the bargaining power of buyers. The bargaining power of suppliers, the threat of buyers' bargaining power, and the threat of new entrants in the marketplace are all comparatively weak or moderate elements.Porter's five forces is a widely used framework for analyzing industries. It refers to the competitive influences shaping the corporate strategies that are likely to be successful. The framework has held up well over time and continues to be a staple of the coursework for business classes.

What is the purpose of Porter’s : Porter's five forces are used to identify and analyze an industry's competitive forces. The five forces are competition, the threat of new entrants to the industry, supplier bargaining power, customer bargaining power, and the ability of customers to find substitutes for the sector's products.