Antwort Which bank gives cheapest personal loan? Weitere Antworten – Which bank offers lowest personal loan

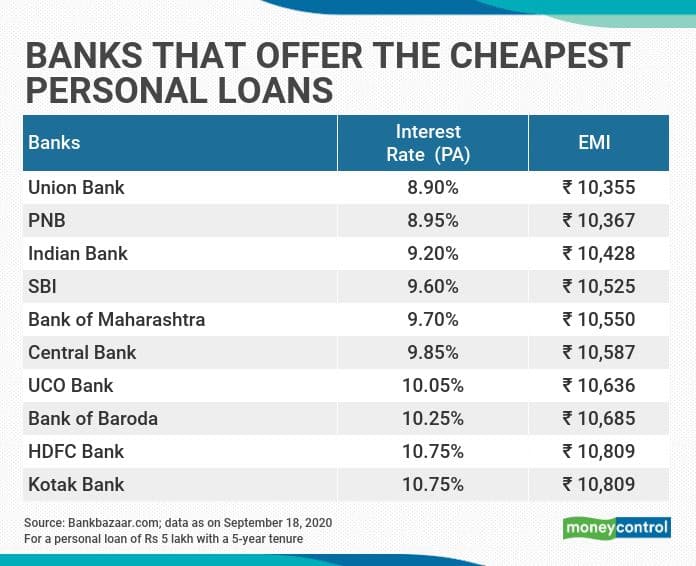

Top 5 banks charge the lowest interest rates:

ICICI Bank: ICICI Bank charges anywhere between 10.65 to 16 percent per annum on loans. The loan processing charges of loan are up to 2.50 percent of loan amount plus applicable taxes. State Bank of India (SBI): SBI charges interest rate that starts from 11.15 percent.Requirements

- You must be 18 years of age or older.

- You must have a regular income or should be able to prove a steady and sufficient proof of income( 3 – 6 months of pay slips for employees, up to two years of balance sheets for freelancers) be presenting a decent SCHUFA score.

- You must have a bank account in Germany.

Some lenders offer introductory promotions with a temporary 0% interest period, but this is typically short-lived, often lasting six to eighteen months before reverting to standard rates.

Can I get a 0% bank loan : There's no such thing as an interest-free personal loan. You'll get charged interest on all loans, so you'll always pay back more than you originally borrowed. But you can get a loan that charges low interest.

Which type of loan is cheapest

Secured loans are typically a more affordable choice as they are backed by collateral and have lower interest rates than unsecured loans.

Which bank is best for taking personal loan : Lowest interest rates charges by banks on their personal loans:

| Bank | Minimum interest rate on personal loan (%) |

|---|---|

| Bank of Baroda | 13.15 |

| Punjab National Bank | 13.75 |

| Kotak Mahindra Bank | 10.99 |

| Axis Bank | 10.65 |

Our personal loans are bound to bring a smile to your face, while our loan repayment rates are designed to help you sleep well at night. As a long-standing and expert loan provider, your Sparkasse is an institution you can trust with your loan. For more information speak with your client adviser.

Loans in germany for foreigners

To be eligible for a loan, you must be of legal age, reside in Germany, and have a German bank account. Additionally, banks impose their own conditions for granting loans. For instance, most banks require loan applicants to have a certain income level and stable employment.

How to get a low-interest personal loan

An excellent credit score, consistent income and low debt-to-income ratio are key to securing a low-interest personal loan. But if your finances aren't in the best shape, consider taking a step back to improve your credit score and lower your utilization rate before applying.It's possible to use a balance transfer card as an interest-free loan on high-dollar purchases. Simply look for a card that offers 0 percent interest on purchases, as well as balances you transfer. Then prioritize paying off your purchases before the promotional period ends.Banks or credit unions typically offer the lowest annual percentage rates, which represents the total cost of borrowing, for personal loans. Loan amounts range from a few hundred dollars to $50,000 or more. Some banks may provide an additional APR discount to existing customers.

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

How to obtain a Personal Loan at a low interest rate

- How to obtain a Personal Loan at a low interest rate

- A good credit score is important.

- Maintain a clean and good record of repayment history.

- Compare Personal Loan interest rates and watch out for seasonal offers.

- Consider your Employment history.

- Employer's credibility.

Which bank personal loan is best : Top Personal Loans Plans in India 2024

| S.No. | Personal Loan Plans | Interest Rates |

|---|---|---|

| 1. | HDFC Bank Personal Loan | 10.50% p.a. onwards |

| 2. | ICICI Bank Personal Loan | 10.50% p.a. onwards |

| 3. | Bajaj Finserv Personal Loan | 13.00% p.a. onwards |

| 4. | Fullerton India Personal Loan | 11.99% p.a. onwards |

Which bank has the best personal loan rates : Summary: Best Personal Loans From Banks

| Company | Forbes Advisor Rating | Current APR range |

|---|---|---|

| Discover | 3.5 | 7.99% to 24.99% |

| Wells Fargo | 3.5 | 7.49% to 23.24% |

| PNC Bank | 3.0 | Rates vary by zip code |

| Citibank | 3.0 | 10.49% to 19.49% |

What is the easiest bank loan to get approved for

Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with essentially no approval requirements typically charge the highest interest rates and loan fees.

How much loan / mortgage can I afford As a rule of thumb, you just need to multiply your monthly net income by 100 to get the maximum loan amount most banks will provide to you. This amount can be 100% of the purchase price.Bank Lending Rate in Germany increased to 6.97 percent in January from 6.07 percent in December of 2023. Bank Lending Rate in Germany averaged 3.57 percent from 2003 until 2024, reaching an all time high of 6.97 percent in January of 2024 and a record low of 1.76 percent in October of 2021.

Which bank is best for personal loan in Germany : TOP 5 German Personal Loan Providers

| Loan Provider | Interest Rate | |

|---|---|---|

| auxmoney – Personal Loan | from 5.40% / year | Order here |

| TARGOBANK – Personal Loan | from 1.75% / year | Order here |

| Postbank – Personal Loan | from 1.95% / year | Order here |

| Santander – Personal Loan | from 1.99 % / year | Order here |